We will introduce useful knowledge about international logistics.

Fun facts about international logistics.

Customs Clearance

Import & Export Service

Experienced specialized staff will handle complex import and export procedures promptly and accurately while meeting the needs of our customers.

Our company handles a wide range of cargoes, including general cargo as well as special cargoes such as food, chemicals, and dangerous goods. Our specialized staff with extensive experience and knowledge handles the complex procedures related to import and export, as well as various legal requirements, promptly and accurately while meeting the diverse needs of our customers.

-

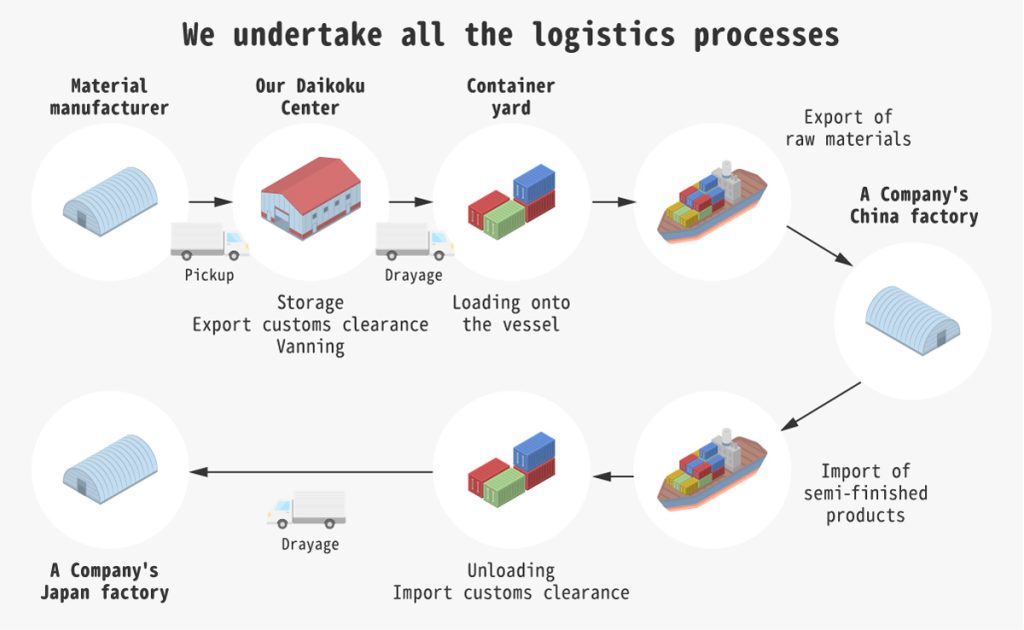

We will respond to our customers’ detailed changes through our one-stop service using our own assets!

For exports, we can handle all export-related tasks, including domestic cargo collection, customs clearance, and shipping arrangements, to customs clearance and local delivery in foreign countries. For imports, we can handle all tasks, including foreign cargo collection, customs clearance, and delivery to end-users in Japan, using our own assets. We can flexibly respond to all aspects of import and export-related tasks according to our customers’ needs. By using our one-stop service instead of multiple vendors, we can provide a cost-competitive advantage to our customers.

-

Careful, prompt, and accurate!

Our staff responsible for operations handles arrangements for cargo pickup and delivery, while our registered customs specialist directly communicate with customers to support tasks related to customs clearance and obtaining import/export permits, including other regulatory applications. By having specialized staff members directly communicate with our customers for each task, we can provide efficient and detailed support, reducing lead time and avoiding unnecessary delays.

-

Our team of export/import procedure professionals provides total care!

We have a proven track record of handling a wide range of cargoes, regardless of their type, and have accumulated a wealth of know-how. Our specialized staff, with extensive experience and knowledge, will respond to our customers’ needs. Please feel free to consult us about any cargo-related issues you may be unsure about. We will provide detailed guidance to ensure our customers’ complete satisfaction.

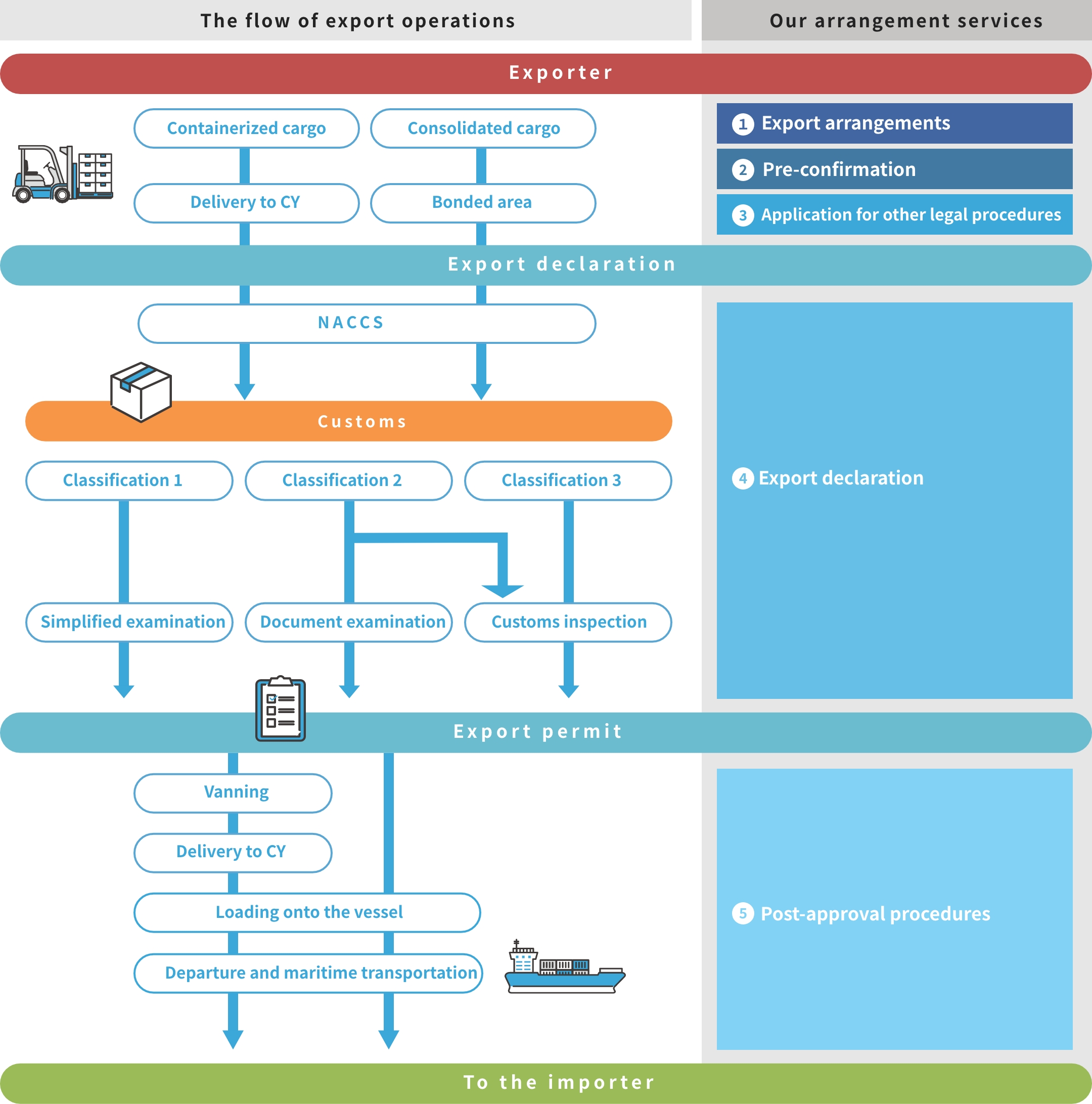

Biz Flow Export

The flow of export operations

-

- 1Export arrangements

- We consult with customers and arrange the procedures required to export (booking vessels, pickup container, drayage/truck, packing etc.)

-

- 2Pre-confirmation

- In order to proceed with the export customs clearance process quickly and accurately, we will confirm whether the information provided by the customer (such as invoices, product description, catalogs, etc.) complies with various laws and regulations and treaties. We will provide advice in advance if necessary.

-

- 3Application for other legal procedures

- Exported goods are regulated by various laws and treaties such as the Foreign Exchange and Foreign Trade Act (Export Trade Control Order, etc.) and the Basel Convention (regulation aimed at preventing pollution caused by hazardous waste), depending on the item. When attempting to export goods regulated by these laws and treaties, it is necessary to thoroughly confirm whether the item falls under the relevant category and obtain the necessary permission or approval from the relevant government agencies in accordance with the laws and regulations, and to prove such permission or approval to the customs authorities.

-

- 4Export declaration

- When exporting goods from Japan to foreign countries, it is generally required to file an export declaration with the customs office that has jurisdiction over the bonded area where the goods are stored. For goods that require inspection by customs, they must undergo an inspection and obtain an export permit after the export declaration has been filed.

-

- 5Post-approval procedures

- After obtaining the permission for export declaration, we create a Dock Receipt and submit it to the shipping company. After confirmation of departure, we make payment to the shipping company and request the issuance of a Bill of Lading (B/L). By handing over the issued B/L to the importer through the exporter, the foreign cargo pickup becomes possible.

At our company, our staff members in charge of export operations are responsible for 1. Export arrangements and 5. Post-approval procedures in the above flow, while our registered customs specialist are responsible for 2. Pre-confirmation, 3. Application for other legal procedures, and 4. Export declaration.

Please leave everything to our professional team at our company!

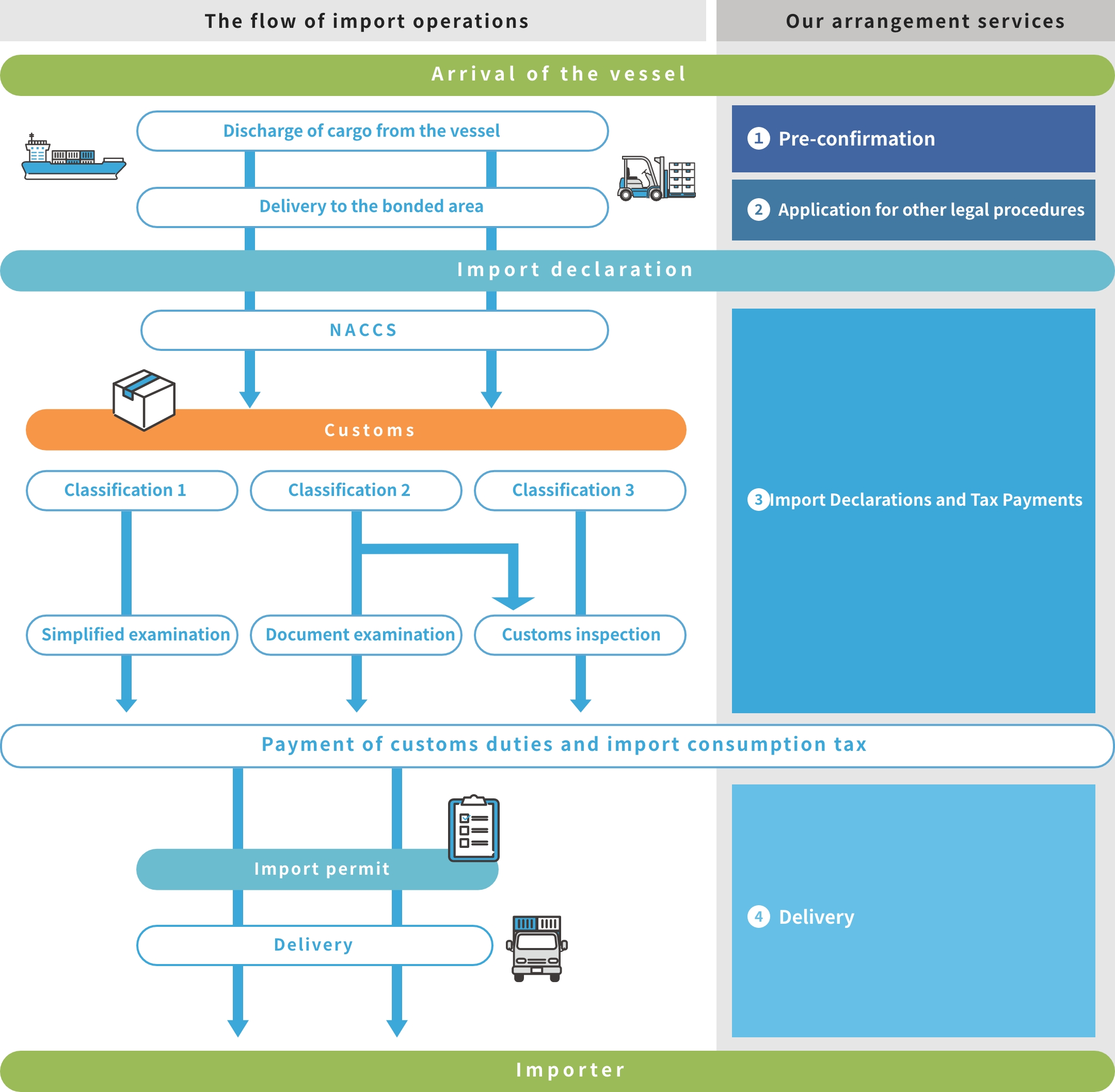

Import

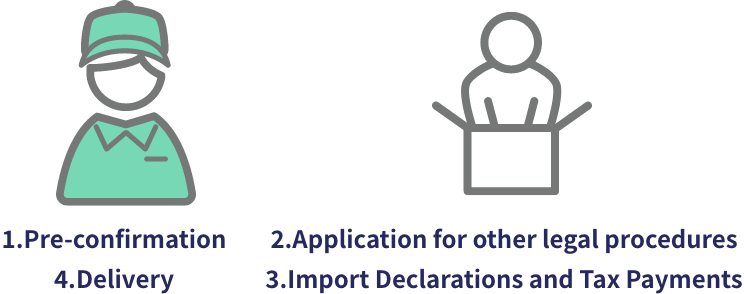

The flow of import operations

-

- 1Pre-confirmation

- To carry out import procedures quickly and accurately, we will confirm whether various laws and treaties apply based on information provided by the customer (such as invoices, product descriptions, catalogs, etc.). If necessary, we will prepare the necessary documents for other legal applications.

-

- 2Application for other legal procedures

- Imported goods are regulated by various laws and regulations such as the Food Sanitation Act, Plant Protection Act, and Livestock Infectious Diseases Prevention Act depending on their product category. When importing goods that are subject to these regulations, it is necessary to confirm whether they fall under the regulated category and to provide proof to the customs that the relevant authorities have granted permission or approval according to the law.

-

- 3Import Declarations and Tax Payments

- When importing goods from abroad into our country, it is generally required to file an import (tax payment) declaration with the customs office having jurisdiction over the bonded area where the goods are stored. After the import declaration, for goods that require inspection by customs, inspection is conducted and by paying customs duties, domestic consumption taxes, and local consumption taxes, permission for importation is granted.

-

- 4Delivery

- After obtaining permission for import, the goods can be picked up by exchanging a Delivery Order. We arrange container drayage or trucking based on the customer’s request and deliver the goods safely and quickly. In cases where delivery by container drayage is not possible, we can also deliver the goods by reloading them onto a truck at our warehouse.

For the above flow, in our company, our staff members in charge of import operations are responsible for 1. Pre-confirmation and 4. Delivery, while our registered customs specialist handle 2. Application for other legal procedures and 3. Import Declarations and Tax Payments.

Please leave everything to our professional team at our company!

Other laws and regulations

If the cargo to be imported or exported requires permits or approvals based on laws and regulations other than customs-related ones (i.e., other laws and regulations), it is necessary to obtain such permits or approvals from the competent authorities based on those other laws and regulations. Our customs brokers will handle the application process on your behalf, so you can rest assured. In addition, since our Daikoku Center is a bonded warehouse, we can offer high convenience and cost savings for cargoes that require inspections under other laws and regulations by having them first transported to our center. For cargoes subject to animal quarantine in particular, please take advantage of our warehouse, which is registered as a designated animal quarantine warehouse.

Other laws and regulations

regulations items Details and procedures the authorities concerned

Food additives, dishware,toy etc. When importing food or other items, it is necessary to submit a notification to the Minister of Health, Labor, and Welfare based on the Food Sanitation Act, from the perspective of ensuring their safety. The notification is submitted to the Quarantine Station of the Ministry of Health, Labor, and Welfare using the “Notification of Importation of Food and Other Items” form. Ministry of Health,

Labour and Welfare

Poisonous and Deleterious Substances Control Act

High Pressure Gas Safety Act etc. Please do not hesitate to contact us for any inquiries or concerns you may have. Each relevant ministry and agency

If you make a mistake in the export/import customs clearance procedures, it not only leads to illegal acts but also results in unnecessary time and costs before the goods are delivered to your customers. If you are considering new cargo export/import customs clearance procedures, please do not hesitate to consult with us. We will provide total care to ensure that your goods are delivered to you as quickly and cost-effectively as possible.